// case study 006

Protecting people from debt.

60

% spent on debt

Monthly Income

R 23 345.00

Services Provided

Product Design

Web Development

Technology

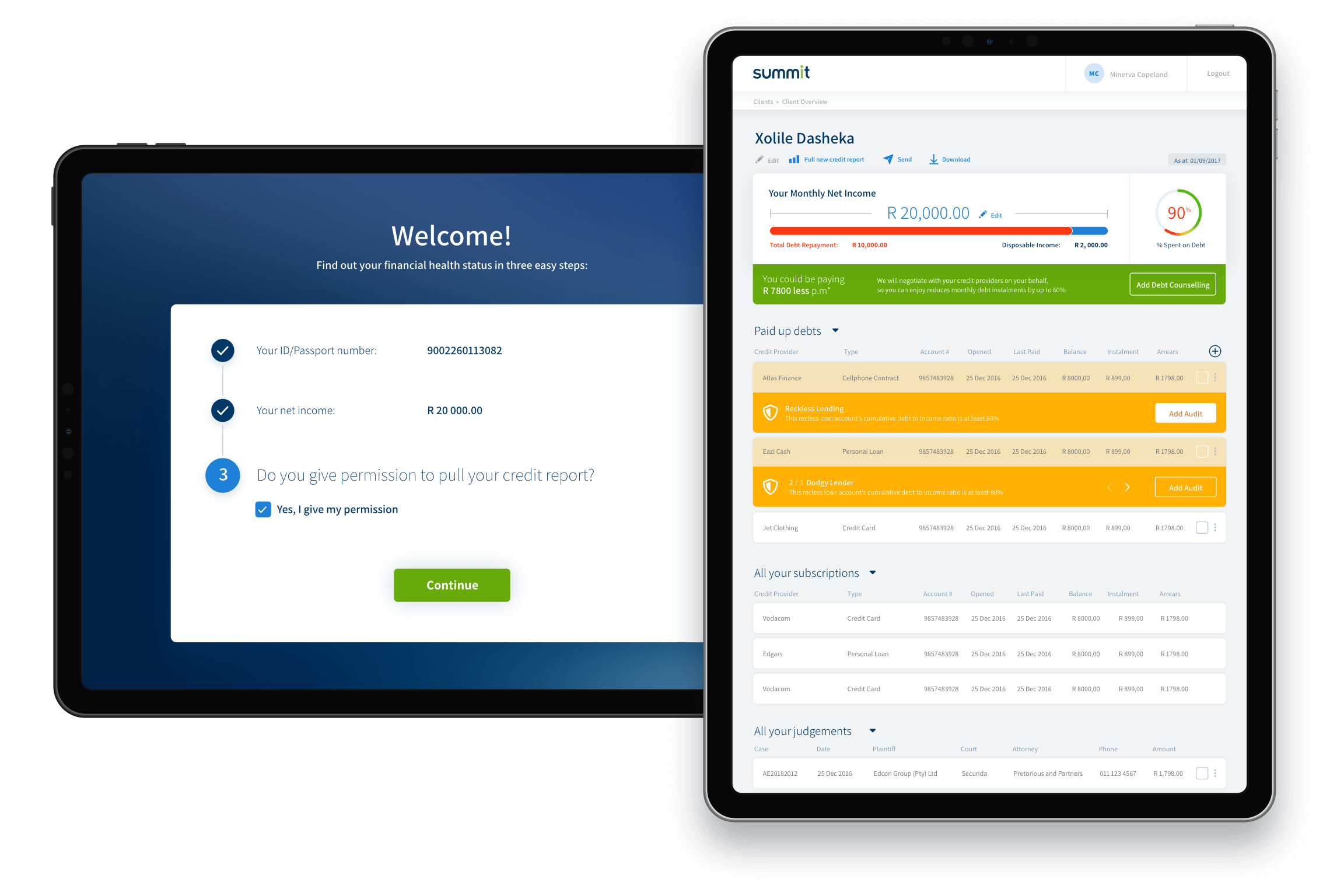

Summit protects consumers against unscrupulous lenders and helps employers guide staff in making better financial decisions.

The Challenge

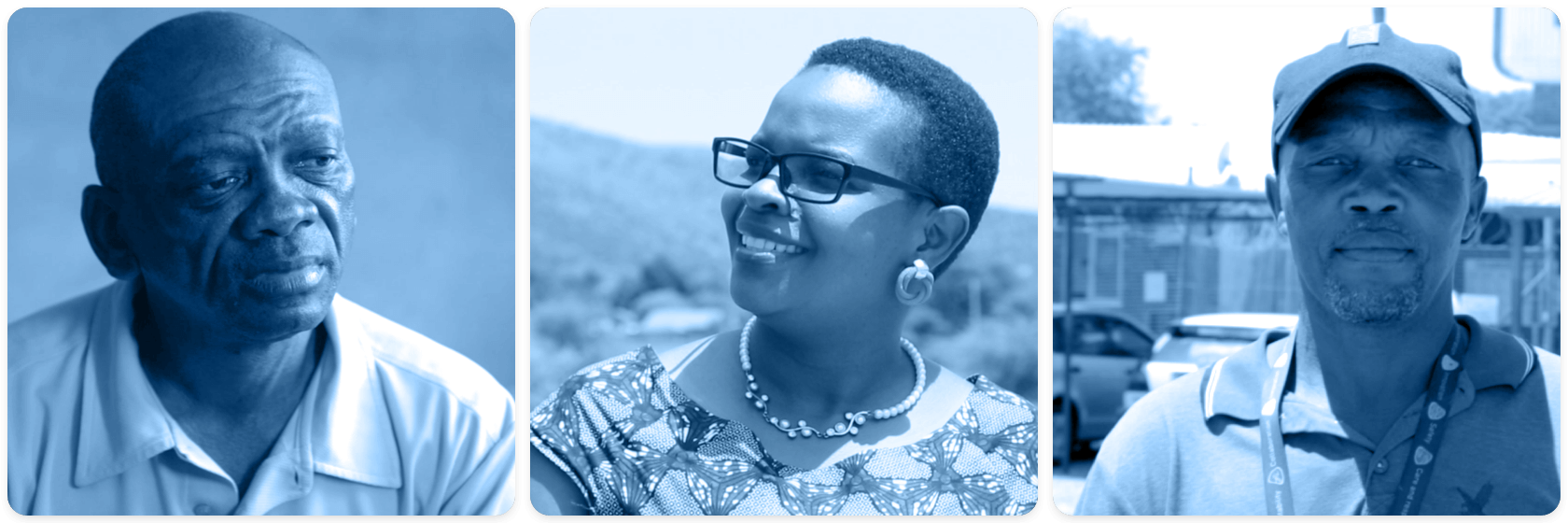

With the aim of protecting susceptible blue-collar workers against unscrupulous lenders and collectors, Summit consultants visit employers on site to help their workers with debt management. These consultants operate in low signal areas, such as mine sites. They face further difficulties such as language barriers, noisy environments and manually intensive processes.

The existing platform we built for Summit, called 6cents, needed a reboot. When Summit approached Platform45 in September 2017, we suggested a complete rethink. The application was initially intended to be a desktop app only, but a web application made more sense.

The Solution

Platform45 visited one of Summit’s clients based on a mine to conduct contextual research, shadowing our client’s consultants and end-users as they used the 6cents platform. When miners, who want to apply for housing near their workplace, the housing department on the mine-site sends them to a Summit consultant to pull their credit report. If there is an irregularity on a credit report or the end-user has an emolument attachment (or garnishee order) on their salary, Summit is on site to help pull the user out of debt and fight against the credit providers who gave the credit unethically and unlawfully.

We used Scrum methodology and agile ideology in weekly sprints. Our robust acceptance criteria meant we could scrutinise the product and open the product offering with the most expedited possible process to application. Our tech stack allowed us to efficiently build features, firmly focussed on implementing sophisticated processes in a simple user experience.

The new Summit product (MVP launched in February 2018) shares similar features with 6cents but is leaps and bounds ahead of the old platform. Leveraging the updated UX for the on-boarding and applications, the app is central to how Summit functions as a company.

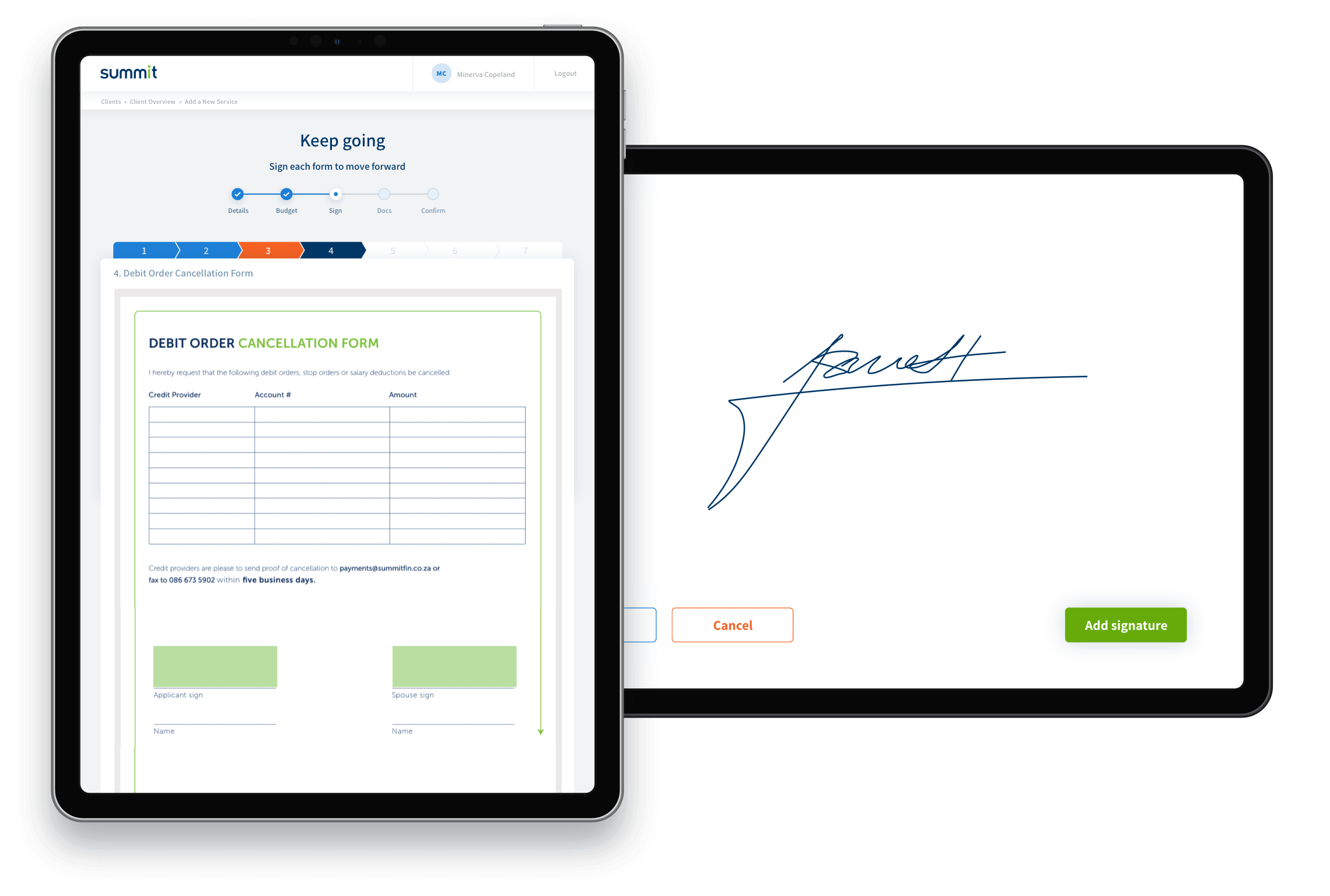

The most significant accomplishment of the Summit app is its simplicity, while the most significant benefit is the new built-in digital signature capability, which significantly reduces paperwork and shortens the process immensely.

The Summit web app pulls an accurate credit report for a client. If the credit bureau has no record of the client, the consultant can still onboard the client manually. Extra functionality means consultants only need to add details once and the app automatically pre-populates all documents. These documents can be displayed onscreen and then converted into signed PDFs.

Since inception, Summit has onboarded 2,500 users and is currently being used by 24 consultants. Several hundred people are now undergoing debt counselling. Most importantly, several hundred unethically provided loans are now being audited.

What's Next

Next up is integration with Salesforce and taking the platform direct to consumers, going from blue collar to white collar, and changing the financial destiny of its users.

Benefits to the client:

-

Significantly less paperwork and digital signatures

-

Instant access to clients’ credit history

-

Can be used on a tablet or smart device

-

Single view of finances with a Debt-to-Income ratio calculator

-

Robust platform ready to be taken to the consumer market

Extra Reading

UP NEXT

// case study 003

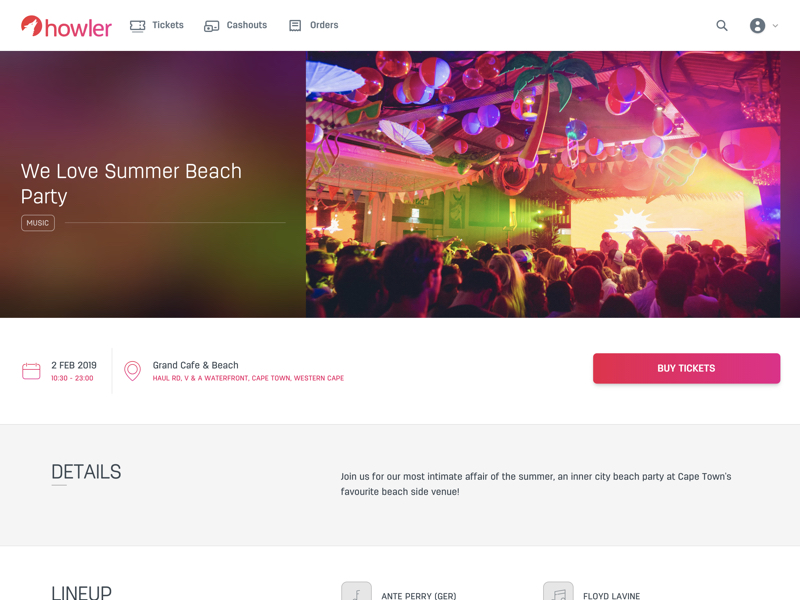

Using software to solve events at every level: creating, organising and enjoying.